360 ONE WAM: PAT up 34% & Revenue up 43% in H1-25 at a PE of 41

AUM growth guidance of 15%. Potential for fund flow guidance to be revised upwards. Robust AUM growth, healthy net flows, successful client acquisition, and strategic expansion initiatives

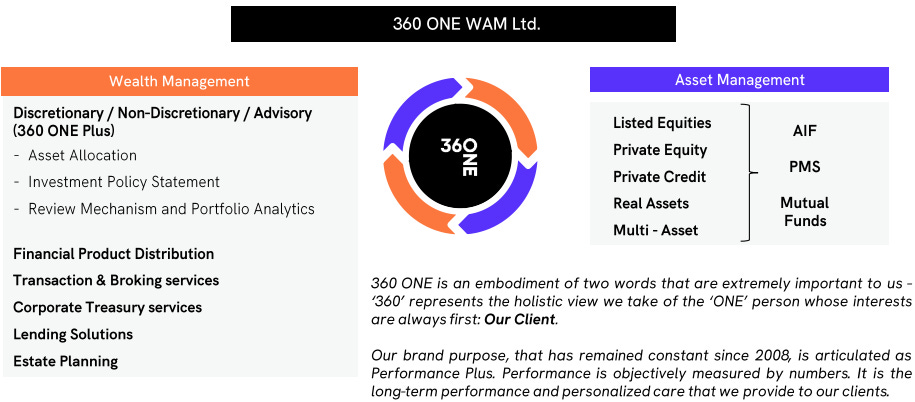

1. Why is 360ONE interesting

iiflwealth.com | NSE: 360ONE

India's Wealth & Asset Management sector is poised for structural growth in the coming years. This growth will be driven by robust GDP growth, capital market expansion, faster wealth creation outside traditional pockets, and overall low penetration in the sector. 360ONE as one of India’s largest wealth manager servicing 7,400+ clients would be a big beneficiary of this upcoming growth. 2. Wealth and alternates-focused asset firm

One of India’s largest wealth manager servicing 7,400+ clients

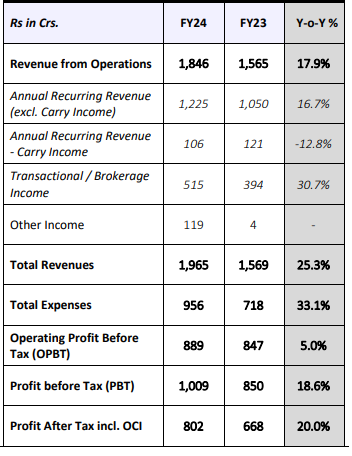

3. FY20-24: PAT CAGR of 40% & Revenue CAGR of 19%

4. Strong FY24: Revenue up 20% & Revenue up 18%

5. Strong Q2-25: PAT up 33% & Revenue up 38% YoY

PAT up 2% & Revenue down 2% QoQ

6. Strong H1-25: PAT up 34% & Revenue up 43% YoY

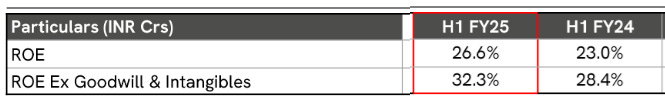

7. Business metrics: Strong & improving return ratios

We expect this ROE to sustain while we continue to invest in future growth areas.

8. Strong outlook: Macro tailwinds to drive 15% AUM growth

i. AUM growth of 15%

Well, from an AUM based perspective right now, obviously in our guidance, we've not fully factored in our mid market and global businesses.

In a steady state basis, assuming tougher capital markets for some time during the next 3-4 years, if I take an average over a 3 4, 5 year time period, a net flow growth of round about 15% to 20% is broadly where I would feel very, very comfortable with

But a 15% growth in AUM due to net flows would be great.

ii. Possibility of Full-year flow guidance to be revised upwards

Full-year flow guidance: While the current guidance remains at ₹25,000-30,000 crores, it could potentially be revised upwards based on the strong Q2 performance.

iii. Macro tailwinds supporting growth

We are optimistic about the substantial wealth opportunity beyond Tier-1 cities and have an expansion plan for our domestic coverage.

We expect to leverage the strength of our core platform and innovative competences to fuel high growth in the HNI segment as well as become a favoured manager of global capital looking to access India.

The unique blend of macro tailwinds and our distinctive proposition continues to consolidate our position as one of the leading players in India

At 360 ONE, our focus on consolidation has laid a strong base for future growth and strengthened our position as one of the leading players in India.

9. PAT growth of 34% & Revenue growth of 43% in H1-25 at a PE of 41

10. Hold?

If I hold the stock then one may continue holding on to 360ONE

360ONE has delivered a strong Q1-25 with robust revenue growth, impressive profit margins, and a high tangible RoE

reported its highest ever quarterly profit after tax (PAT) of ₹247 crores, a 33.4% year-on-year increase

360ONE is in the middle of a strong run it has grown its top-line, bottom-line and AUM QoQ on a sequential basis. This performance is driven by a strong underlying business performance. One can easily keep riding ride the trend of strong quarterly performances.

Q2-25: successfully onboarded 160+ clients (with more than Rs 10 Crs ARR AUM).

During this period, clients having ARR AUM above Rs 50 Crs, increased by 70+.

Overall, the segment manages assets for 7,500+ relevant clients

Q1 FY25: 150+ clients ((with more than Rs 10 Crs ARR AUM).

FY24: onboarded 400+ clients (with more than Rs 10 Crs ARR AUM).

The revenue visibility of 360ONE is strong. 67% of Q2-25 revenue was Annual Recurring Revenue (ARR) vs 63% in Q1-25

Possibility of flow guidance to be revised upwards after Q2-25 pointing to a strong momentum in the business.

11. Buy?

If I am looking to enter 360ONE then

360ONE has delivered PAT growth of 34% and revenue growth of 43% in H1-25 at a PE of 41 which makes the valuations fully valued in the short term.

With an outlook of AUM growing by 15% over the longer term and the marco tailwinds supporting the growth in wealth management the opportunity in 360ONE will emerge over the longer term.

There is long term opportunity in 360ONE only if the momentum of the last 5 years continues into FY26 and beyond. On the flip side the margin for error is small. One bad quarter and the asking rate to sustain a PE of 41 will become quite high. At a PE of 41, the stock can become expensive quite quickly if execution falters by a little. Positions need to be built over time over bad days or periods when the stock is not doing well.

Previous Coverage of 360ONE

Don’t like what you are reading? Will do better. Let us know at hi@moneymuscle.in

Don’t miss reading our Disclaimer